Ty Robinson | August 6, 2025 | Car Accidents

Getting into a car accident is stressful enough. The situation becomes even more frustrating when you discover the at-fault driver does not have insurance. You may wonder who will pay for medical bills, lost wages, and vehicle repairs.

Fortunately, South Carolina law provides options for victims, but the steps you take after a crash can significantly impact your ability to recover compensation. Acting quickly can help protect your health and legal rights. Contact a Charleston car accident attorney for further assistance.

Understanding South Carolina’s Car Insurance Requirements

South Carolina requires all drivers to carry minimum liability insurance coverage in the following amounts:

- $25,000 for bodily injury or death per person

- $50,000 for total bodily injury or death per accident

- $25,000 for property damage per accident

The state also requires uninsured motorist (UM) coverage in the same amounts. This protects you if you are hit by a driver with no insurance or involved in a hit-and-run. It is automatically included in every auto policy issued in the state, so you do not have to purchase it separately.

However, despite these requirements, some drivers still operate vehicles without insurance. When they cause an accident, victims often must rely on their own policies or explore other legal avenues for recovery.

Seek Medical Care and Report the Accident

Your first priority should be safety and health after an accident, regardless of the other driver’s insurance status. Call 911, request medical assistance, and have law enforcement file an accident report. This will document the fact that the other driver did not have insurance, which will be important for your claim.

You should also try to gather:

- The other driver’s contact information

- Vehicle make, model, and license plate numbers

- Witness statements and contact details

- Photos of the accident scene and damages

Thorough documentation can make it easier for your attorney to prove liability and secure compensation later. Even small details, such as road conditions or traffic signals, can strengthen your case. A friend, family member, or even witness can assist if you are unable to do so after an accident.

Using Your Uninsured Motorist Coverage

Your uninsured motorist (UM) coverage is typically the best way to recover damages after an accident with an uninsured driver in South Carolina. This coverage can help pay for:

- Medical expenses

- Lost wages

- Pain and suffering

- Vehicle repair or replacement costs

Your UM claim will be filed with your own insurance company, but that does not mean they will automatically pay you what you deserve. Insurance adjusters may still dispute your injuries, question your medical care, or attempt to minimize your payout. They may also request extensive documentation, which can slow down the process.

Your compensation will also be limited to the amount of coverage in your policy. Understanding the terms of your policy before filing a claim can help you avoid surprises and position you for a stronger outcome.

What if My Losses Exceed My Uninsured Motorist Coverage?

You may have other options for recovering compensation after an accident with an uninsured driver if the damages are greater than your UM policy limits. You may be able to pursue compensation from:

- Underinsured motorist (UIM) coverage: Underinsured motorist (UM) coverage could help cover the gap when an at-fault driver’s insurance (or your UM limits) is insufficient. Having UIM coverage is not mandatory in South Carolina, but it can be a valuable safeguard in serious accidents.

- A personal injury lawsuit against the driver: You can sue the uninsured driver directly. However, many uninsured drivers lack significant assets, making it challenging to settle a case or collect a judgment even if you win.

- Other liable parties: Responsibility for the crash may extend beyond the uninsured driver. For example, an employer could be liable if the driver was working at the time of the crash, a vehicle manufacturer could be at fault for a defect, or a government entity could be responsible for hazardous road conditions.

A car accident lawyer can review your situation, determine the true value of your claim, and identify every possible source of recovery. They can also help you decide when it is worth pursuing legal action and when to focus on negotiating with insurers for maximum compensation.

Challenges in Uninsured Motorist Cases

Even with UM coverage, uninsured driver claims can be complex. Victims often face multiple obstacles when trying to secure fair compensation. Common challenges include:

- Proving the uninsured driver was at fault: This may require accident reconstruction, witness statements, and police reports to establish liability.

- Disputes with your own insurance company over damages: Insurers may undervalue your injuries, question your medical treatment, or challenge the repair costs for your vehicle.

- Delays in processing claims: Insurance companies sometimes use stalling tactics, dragging out the claims process in hopes you will accept less.

- Hit-and-run cases where the driver cannot be identified: Proving eligibility for UM benefits can become more complicated without a known at-fault driver.

- Policy exclusions or coverage disputes: Your insurer may claim that certain damages are not covered under your UM policy, limiting your recovery

- Difficulty calculating long-term damages: Insurers may push for a settlement that falls short of your true costs without a clear picture of ongoing medical needs or future wage losses.

Insurance companies are often more concerned with their bottom line than with paying claims fairly. Having a Charleston personal injury lawyer on your side can help you navigate these challenges, gather strong evidence, and push for a faster resolution.

Their involvement can also deter insurers from using delay tactics, as they know a lawyer will be prepared to take the case to court if necessary.

In a Car Accident? Contact a Charleston Car Accident Lawyer Today

If a driver hit you without insurance in South Carolina, you still have options for recovering your losses. Your uninsured motorist coverage can be a critical lifeline, but having an experienced lawyer can maximize your recovery.

The sooner you get legal help, the stronger your case can be. Contact a Charleston car accident lawyer with Ty Robinson Law Firm today for a free consultation to learn about your rights and potential compensation.

Contact Our Charleston Car Accident Lawyers At Ty Robinson Personal Injury & Car Accident Law Firm Today

If you were injured in an accident in Charleston, South Carolina, and need legal help, contact our Charleston car accident lawyer at Ty Robinson Personal Injury & Car Accident Law Firm to schedule a free case review today.

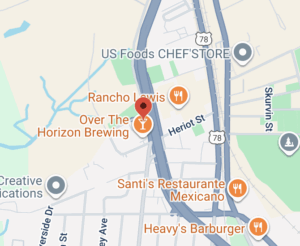

Ty Robinson Personal Injury & Car Accident Law Firm

28 Broad St Suite 204-2

Charleston, SC 29401

(843) 278-2222