Ty Robinson | October 14, 2025 | Truck Accidents

MCS-90 is a federally mandated endorsement added to commercial auto insurance policies for motor carriers engaged in interstate commerce. It guarantees financial responsibility for bodily injury and property damage caused by commercial vehicles, even when certain policy exclusions apply.

Professionals in trucking, logistics, and insurance in Charleston, South Carolina, should understand the significance of MCS-90. It plays a crucial role in ensuring public safety and providing compensation to accident victims involved in crashes with large trucks or commercial carriers.

Compliance with MCS-90 helps carriers meet legal obligations and protect the public. Reach out to a truck accident lawyer in Charleston for further assistance on your case.

The Basics of MCS 90

MCS 90, or the MCS-90 endorsement, is part of Federal Motor Carrier Safety Administration (FMCSA) regulations. It is required for motor carriers who operate in interstate commerce. If their vehicles travel across state lines, MCS-90 is necessary.

Key points about MCS 90 include :

- It is a federal requirement for interstate commercial carriers.

- It ensures that victims of truck accidents can receive compensation.

- It applies even if the insurance policy would not normally cover certain liabilities.

The endorsement is added to a motor carrier’s insurance policy. It ensures the insurance company pays for damages from an accident, even if those damages go beyond the policy limits.

Who Needs MCS 90?

MCS 90 applies to companies and drivers using commercial vehicles that fit federal definitions. This includes:

- Trucking companies operating across state lines.

- Bus operators transporting passengers interstate.

- Freight carriers moving goods between states.

- Any business using commercial vehicles subject to FMCSA oversight.

Carriers in South Carolina that only operate within the state may not need MCS 90. However, those looking to expand or cross state lines must comply.

Purpose of the MCS 90 Endorsement

The main purpose of MCS 90 is to protect the public. It offers a financial guarantee. This ensures that injured parties or property owners can get damages if a commercial vehicle is in an accident.

Essentially, it:

- Ensures coverage: The endorsement obligates the insurance company to pay up to the required limits, even if the carrier’s policy is insufficient.

- Promotes accountability: Carriers must carry adequate insurance to operate legally in interstate commerce.

- Supports victims’ rights: Individuals harmed by accidents involving commercial vehicles have a clearer path to compensation.

Without MCS 90, victims might struggle to get paid for damages from careless motor carriers.

How MCS 90 Works

MCS 90 functions as an insurance endorsement, but it does not provide standalone coverage. Instead, it modifies an existing commercial auto insurance policy. Key aspects include:

- Limits of liability: The endorsement must meet federal minimums, which vary based on the type of vehicle and cargo.

- Third-party claims: Ensures compensation for bodily injury or property damage caused to others by the insured vehicle.

- Supplement to policy: Activates when an accident exceeds standard coverage limits or falls outside normal policy exclusions.

For example, if a commercial truck causes a multi-vehicle accident and the damages exceed the carrier’s insurance limits, MCS 90 obligates the insurer to cover the additional liability up to the required federal limits.

Federal Regulations and Compliance

The FMCSA sets the rules for MCS 90 compliance under Title 49 of the Code of Federal Regulations. Carriers must demonstrate proof of insurance and proper endorsement to operate legally.

Failure to comply can result in:

- Fines and penalties

- Suspension of operating authority

- Increased liability in legal actions

Insurance companies that issue commercial auto policies must add the MCS 90 endorsement if federal law requires it. Proper documentation ensures that carriers remain in compliance and that the public is protected in the event of accidents.

Implications for Charleston, SC, Carriers

Carriers based in Charleston, South Carolina, should carefully assess whether MCS 90 applies. Intrastate-only operators might not always need the endorsement. But if they expand into interstate commerce, federal requirements kick in.

Proper compliance ensures that:

- Drivers meet legal requirements to operate across state lines

- Victims of accidents involving commercial vehicles have access to compensation

- The carrier avoids costly fines, lawsuits, and operational disruptions

Consulting with insurance providers or legal experts familiar with FMCSA regulations is critical for carriers to confirm proper coverage and endorsement requirements.

Common Misconceptions About MCS 90

There are several misconceptions about MCS 90 that carriers should understand, including:

- It is not separate insurance: MCS 90 only works as an endorsement to an existing policy.

- It does not cover the carrier’s employees: The endorsement protects third parties, not the driver or company directly.

- It does not eliminate liability: Carriers are still responsible for negligent acts; MCS 90 ensures the insurance company will pay.

Understanding these points helps carriers and victims navigate legal and insurance matters after commercial vehicle accidents.

Importance of MCS 90 for Safety and Accountability

The MCS-90 endorsement plays a vital role in promoting safety and accountability within the commercial transportation industry. By requiring carriers to maintain adequate financial responsibility, it helps ensure that accident victims receive compensation—regardless of policy exclusions—thereby reducing financial risks for all parties involved.

For commercial carriers in Charleston, compliance with MCS-90 requirements demonstrates a commitment to responsible operations. It safeguards the public while reinforcing trust in the business, helping protect both the company’s reputation and the community it serves.

Understanding What MCS 90 Means for You

The MCS-90 endorsement is a critical component of insurance coverage for commercial motor carriers operating in interstate commerce. It ensures that accident victims are compensated—even if a policy exclusion would otherwise prevent payment—and holds motor carriers financially responsible for damages caused by their vehicles.

For businesses and drivers in Charleston, understanding the MCS-90 requirement is essential. It not only helps maintain compliance with federal regulations but also encourages safer driving practices and reduces the risk of legal complications following a serious accident.

If you were injured in an accident in Charleston, South Carolina, and need legal help, contact our Charleston truck accident lawyer at Ty Robinson Personal Injury & Car Accident Law Firm to schedule a free case review today.

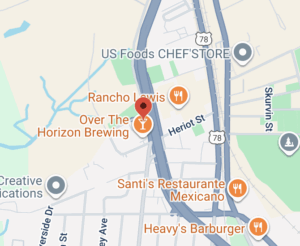

Ty Robinson Personal Injury & Car Accident Law Firm

28 Broad St Suite 204-2

Charleston, SC 29401

(843) 278-2222